This pandemic has reaffirmed that no one knows what the future holds and our capacity us humans to predict the future with certainty is “nil”. That said, whilst we cannot predict the future with certainty, we can prepare adequately for it by relying on our understanding and extrapolation of past patterns – with the knowledge and humility that those patterns may not be repeated in future.

Life before COVID-19

Prior to the economic disruption caused by the virus, Ghana had successfully completed a four-year IMF Extended Credit Facility (ECF) program in April 2019 and had since 2017 been implementing a home grown industrialization agenda seeking to return the country to a path of sustained economic growth. The combined effect of an economic shutdown and the closure of international borders has caused adverse demand and supply shocks to the Ghanaian economy.

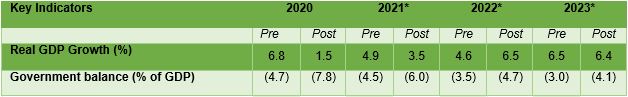

As depicted in the table below the authorities forecast GDP could decline from 6.8% to anywhere between 2.6% and 1.5% whilst the fiscal deficit could increase from a planned 4.7% of GDP to 7.8% of GDP.

*forecast by EIU

Navigating the market in search of fallen angels

The Ghana stock exchange has recorded two consecutive years of negative returns and on a year-to-date (May 2019) basis is down 14% with investors loosing over GHS3billion in the process.

The recovery of risk assets especially on the GSE is expected to be a long and painful one because the drivers of the Ghanaian economy are largely represented in the informal sector which has been hardly hit by the virus. The announcement by the central bank suspending dividend payment by banks to shareholders will reduce liquidity and demand for stocks on the GSE which ultimately will lengthen the time for any recovery.

Healthcare, food, logistics, storage and Information & Communications Technology (ICT) rank as some of the biggest winners in this cycle - but the question is:

- How many of these sectors are adequately represented on our market?

- What kind of financial instruments in these sectors are available to the investing public?

- Is there an inflection point in the economy?

- When and what will be the catalyst for broad market recovery?

It is true the age old adage in investments says; “buy when others are fearful” – and with the market looking very attractive from a valuation standpoint it could be tempting to go treasure hunting. However, as advisors, our concern is on liquidity and the holding period.

The Hunt for Yield

Giving the economic uncertainty, the obvious choice for investors is to hold onto cash or relatively safer fixed income instruments. The combination of low oil prices, constrained government revenue, rising fiscal deficit, a vulnerable currency and rising inflation expectation suggest that the economics are ripe for interest rates to rally north. This is because authorities will need to borrow more to finance the rising deficit. However, the central bank has been on a dovish trajectory for some time as it seeks to provide the impetus for credit and economic growth.

The long walk to freedom

The post COVID-19 world will birth some new ways of doing business, new opportunities and new challenges. The 4th industrial revolution has been greatly accelerated as a result of this pandemic. It is important to remember that the world has been on this dark path before: Sars in 2003, the global financial crisis in 2008, Ebola in 2013 and Zika virus in 2015 – and yet economies still stand strong. COVID-19 will come and go and nations will begin their long walk to economic freedom. As assets look cheap and many opportunities arise, the one advice investors should hold to their chest; caveat emptor (buyer beware).

---

Axis Pension Trust partners workers throughout their retirement planning journey to ensure they are on track to achieve a dignified retirement. For more information on our services or general enquiries, send an email to This email address is being protected from spambots. You need JavaScript enabled to view it. or call 030 273 8555.